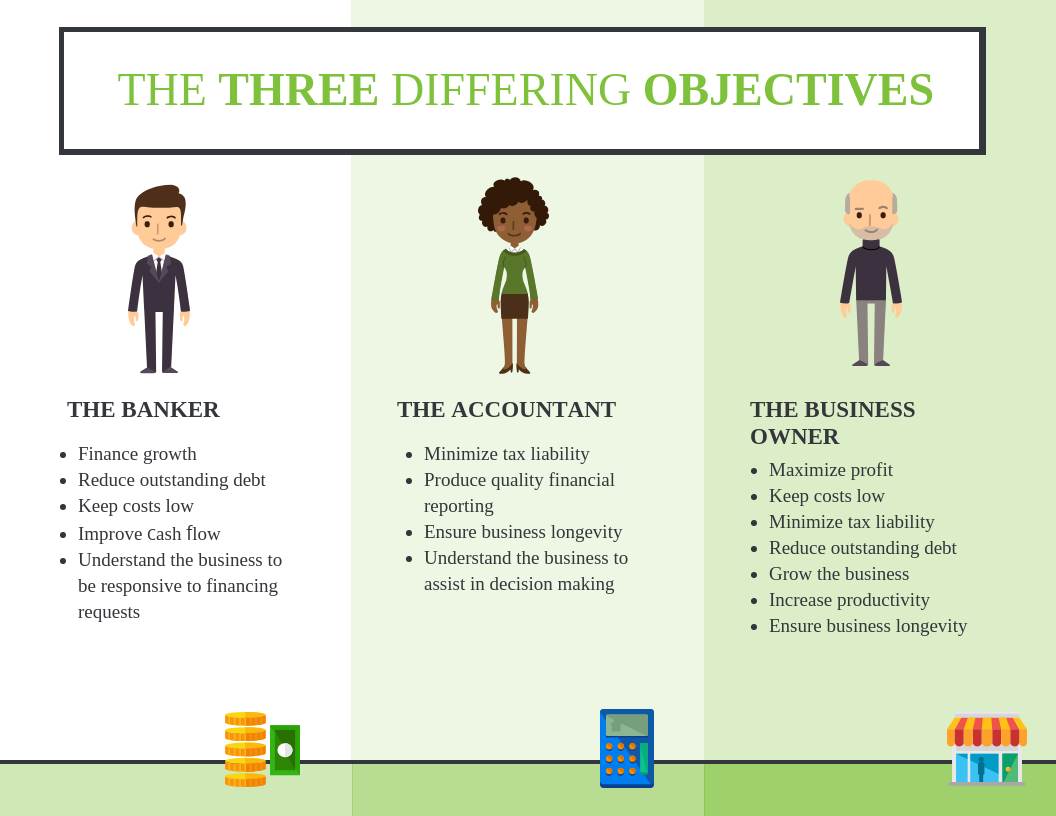

And they each have different objectives.

It sounds like the beginning of a good joke, doesn’t it? We will try to put that together later, but for now, let’s discuss how these individuals deal with the ins and outs of your business.

Let’s discuss the objectives of the banker, the accountant, and the business owner. Each one may have different objectives and some of these objectives may overlap, but it’s important to understand each of their different points of view as we navigate the business world. Let’s start with the business owner.

Business Owner

The business owner may have objectives that include maximizing economic profit, keeping costs low, minimizing tax liability, reducing outstanding debt, growing the business, or enhancing productivity. The business owner typically turns to the banker and the accountant (as well as many other professional and personal advisors) to help meet these objectives.

It’s important to note that accountant and bankers care about their clients and want all of them to succeed. However, the measure of success to the banker or to the accountant may differ.

Accountant

Certainly, the accountant wants the business owner to minimize tax liability. The accountant may also wish to help the business owner to increase profitability and reduce debt. However, the accountant may want to help the business owner to produce the best financial reporting possible for the owner to have a handle on the businesses from a financial perspective. The problem is that to produce quality financial statements the accountant relies on the business owner to spend two valuable resources: money and time.

Creating quality financial statements at a cost and keeping costs low may seem like objectives on different ends of a spectrum, and often they are. This creates that dynamic, that business owners often feel as they go about their day-to-day business lives.

Banker

But guess who else likes high quality financial statements? That’s right, the banker. High quality financial statements make it easier to understand a business and therefore easier to finance a business.

Understanding that business owners desire to keep costs low, while the accountant and the banker both desire high quality financial reporting allows all parties to come up with a reasonable position that everyone can support. Why would the owner of a few single-family rental properties need an audited financial statement? Conversely, why wouldn’t a company with lots of customers and significant working capital turnover want to know as much about their cash cycle as possible? Business owners should seek professional partners that can find the middle ground to help them meet their objectives without unreasonable terms.

Next time, we will discuss a second scenario regarding tax liabilities and get to the punch line of that joke.

At Marine Bank, we desire to find the right balance among differing objectives. Speak to a Marine Bank banker today about meeting your objectives.